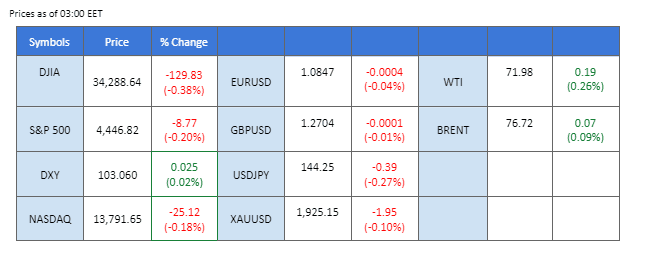

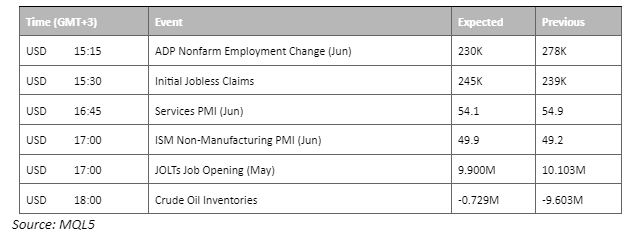

Last night’s release of the FOMC meeting minutes revealed a divergence of opinions among Fed officials, with the majority committed to further rate hikes in their ongoing battle against persistent inflation. The Fed is expected to continue its rate hike cycle this month, indicating a prolonged high-interest rate environment throughout the year. On the other hand, Saudi Arabia’s energy minister expressed a strong commitment to ensuring stability in the oil market, stating they will do “whatever necessary.” and emphasized the continued cooperation with Russia. Adding to the statement, the U.S. API crude oil data showed a significant drop in oil inventories contributing to yesterday’s upward movement in oil prices.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (11%) VS 25 bps (89%)

Following the release of the Federal Open Market Committee (FOMC) meeting minutes in June, the US Dollar experienced a significant surge, bolstering market expectations of an imminent rate hike. With almost all Fed officials in agreement to maintain interest rates at their current levels, the minutes revealed a resolute determination among policymakers to further tighten monetary policy due to the persistently high levels of inflation.

The dollar index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the index might extend its gains after breakout the resistance level since the RSI stays above the midline.

Resistance level: 103.30, 103.90

Support level: 102.50, 101.95

Gold prices faced a setback as they pulled back from a crucial resistance level, driven by the appreciation of the US Dollar. The relentless surge in US Treasury yields further bolstered the appeal of the greenback, following the Federal Reserve’s hawkish stance unveiled in the FOMC meeting minutes. The Monetary Policy Committee (MPC) demonstrated a resolute commitment to tighten monetary policy in response to escalating inflationary pressures.

Gold prices are trading lower following the prior retracement from the resistance level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 38, suggesting the commodity might be traded higher in short-term as technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1930.00, 1950.00

Support level: 1910.00, 1895.00

The strengthened dollar hammered the euro down after the June FOMC meeting minutes revealed. The Fed minutes showed that the Fed officials are keen to continue their rate hike cycle to tame the stubborn inflation; not everyone in the meeting agreed to pause the rate hike in June. It is almost certain that the Fed will at least raise another 25 bps to its interest rate which will support the dollar to trade higher against other major currencies. On the other hand, most European countries have a pessimistic PMI reading which hinders the ECB from implementing aggressive monetary policy and may lead to a weakening euro.

EUR/USD price movement has formed a lower-high price pattern suggesting a bearish bias for the pair. The RSI is moving toward the oversold zone while the MACD flows below the zero line, which also signals bearish momentum.

Resistance level: 1.0951, 1.1027

Support level: 1.0848, 1.079

GBP/USD maintained a positive trajectory as market participants carefully evaluated the necessary measures the Bank of England (BoE) must undertake to tackle inflation. While some experts advocate for a mere two additional interest rate hikes, others caution that several more might be warranted. JPMorgan, in a bold projection, anticipates that the BoE could potentially elevate rates to an unprecedented 7% from the current 5% to restore inflation to its targeted level of 2%. Notwithstanding the BoE’s 18-month rate-hiking campaign, analysts contend that consumers continue to reap the benefits of rising regular wages.

GBP/USD is trading higher while currently near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the pair might be traded lower as technical correction since the RSI retreated from overbought territory.

Resistance level: 1.2740, 1.2825

Support level: 1.2605, 1.2500

The Aussie dollar has rebounded from its week-long downtrend although the RBA decided to pause its rate hike given the country’s CPI dropped more than expected last month. Last night, the release of FOMC meeting minutes hammered the Aussie dollar to fall out of its uptrend channel. The Fed minutes show the Fed is determined to bring down the inflation to their targeted rate at 2% and will continue to raise the interest rate. The deviated monetary policy between the 2 central banks will further weaken the Aussie dollar against the U.S. dollar.

AUD/USD has slightly fallen out of its uptrend channel after its bullish run since the start of July. The RSI has declined to below 50-level while the MACD is breaking below the zero line suggesting the bullish momentum is vanishing.

Resistance level: 0.6694, 0.6744

Support level: 0.6628, 0.6580

The US equity market experienced modest declines on Wednesday as the Federal Reserve’s release of its hawkish-leaning meeting minutes reverberated among investors. These minutes revealed that a majority of the Monetary Policy Committee (MPC) still lean towards a hawkish policy stance during the upcoming meeting later this month. Consequently, US Treasury yields strengthened in response to the minutes, tempering market enthusiasm for the equity market.

The Dow is trading flat while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 60, suggesting the index to be traded lower as technical correction since the RSI retraced sharply from overbought territory.

Resistance level: 34460.00, 35485.00

Support level: 33715.00, 33695.00

Crude oil prices experienced a significant surge as positive inventory data from the United States provided a strong backdrop. The American Petroleum Institute (API) reported a substantial decline of -4.382 million barrels in weekly crude oil stocks, surpassing market expectations of -1.800 million barrels. In a bid to support oil prices, Saudi Arabia, the world’s largest crude exporter, announced its decision to extend its voluntary output cut of 1 million barrels per day (bpd) into August. Additionally, Russia and Algeria joined the effort by reducing their August export levels by 500,000 (bpd) and 20,000 (bpd), respectively.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the commodity will extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 72.60, 74.90Support level: 67.65, 64.50

以行業低點差和閃電般的執行速度交易外匯、指數、貴金屬等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!