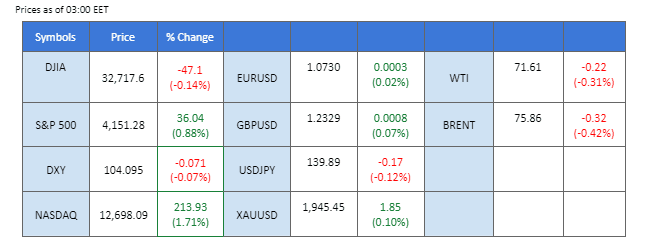

The US Dollar was buoyed by robust US economic data and positive market sentiment. US GDP exceeded expectations, posting a strong growth rate of 1.30% compared to the projected 1.10%. Encouraging job market data also contributed to the dollar’s strength, with Initial Jobless Claims coming in lower than anticipated at 229K. The increased likelihood of a 25-basis point rate hike by the Federal Reserve in June, as indicated by CME’s FedWatch Tool, further reinforces market confidence in the US economy. Meanwhile, gold faced significant losses as the demand for the dollar overshadowed the precious metal. In the Japanese yen market, widening yield spread between the US and Japan continued to dampen the appeal of the yen.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (61%) VS 25 bps (39%)

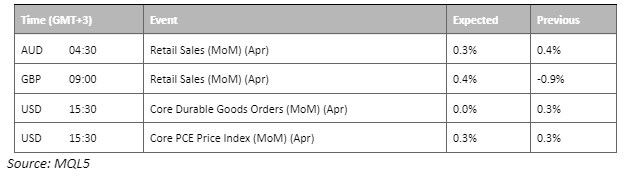

The Dollar Index surged, buoyed by highly encouraging economic data, underscoring the robustness of the US economy. Notably, the US Gross Domestic Product (GDP) for the latest reporting period surpassed market expectations, clocking in at an impressive 1.30% compared to the projected 1.10%. Furthermore, the upbeat economic data extended to the job market, with Initial Jobless Claims coming in at a lower-than-anticipated figure of 229K, outperforming market estimates of 250K.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 80, suggesting the index might enter overbought territory.

Resistance level: 104.20, 105.20

Support level: 103.30, 102.40

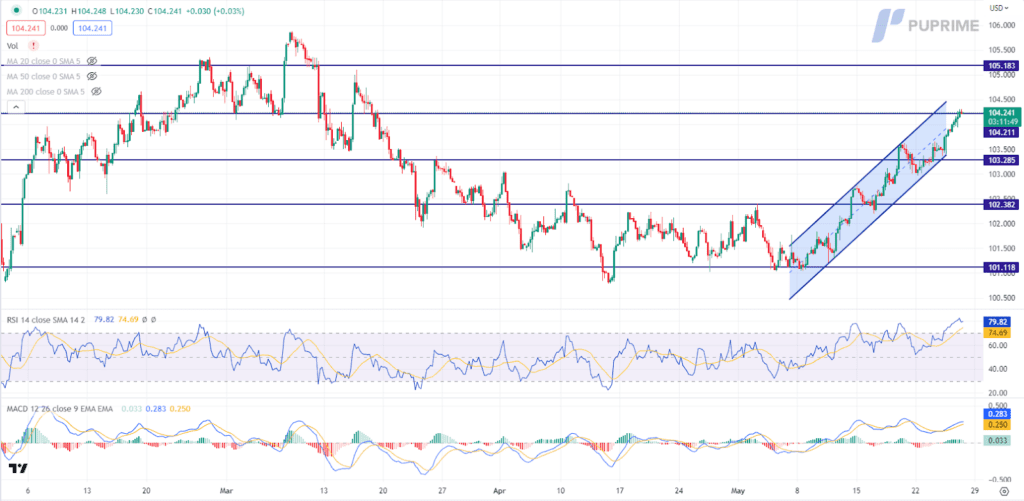

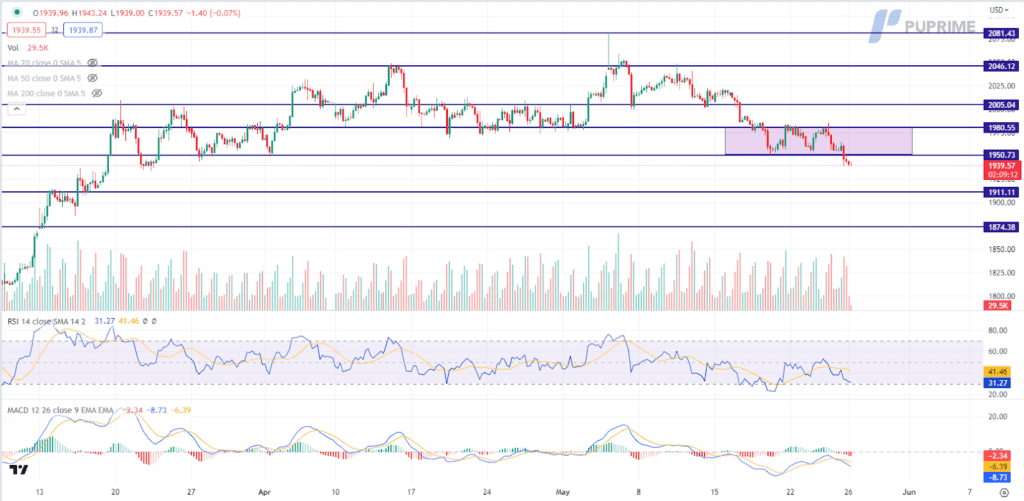

Upbeat economic data from the US has fueled market demand for the US Dollar, resulting in significant losses for the dollar-denominated gold market as it broke below a key support level. The latest US Gross Domestic Product (GDP) figures surpassed market expectations, demonstrating a robust growth rate of 1.30% compared to the projected 1.10%. Additionally, the positive economic sentiment extended to the job market, with Initial Jobless Claims coming in lower than anticipated at 229K, outperforming market estimates of 250K. These impressive indicators have intensified the attractiveness of the US Dollar, prompting investors to shift away from gold and favour the strength of the US currency.

Gold prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 31, suggesting the commodity might extend its losses as the RSI stays below the midline.

Resistance level: 1950.00, 1980.00

Support level: 1910.00, 1875.00

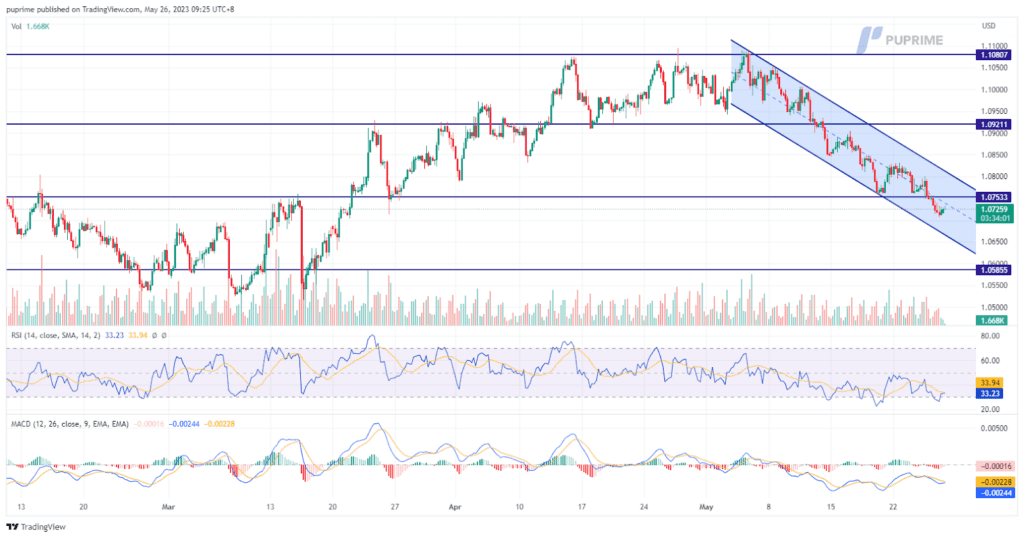

The EUR/USD pair experienced a decline yesterday as the German economy, the largest in Europe, slipped into a recession in the first quarter with a 0.3% decrease in GDP. This news weighed on the euro and caused it to weaken against the U.S. dollar. Additionally, the dollar received an additional boost from the optimistic outlook regarding the debt ceiling. These combined factors led to the euro’s drop against the dollar in yesterday’s trading session.

The euro witnessed a slight downward movement, trading below a key support level in the market. A decline in the euro was accompanied by indicators such as the RSI and MACD, signalling weak momentum.

Resistance level: 1.0765, 1.0850

Support level: 1.0680, 1.0614

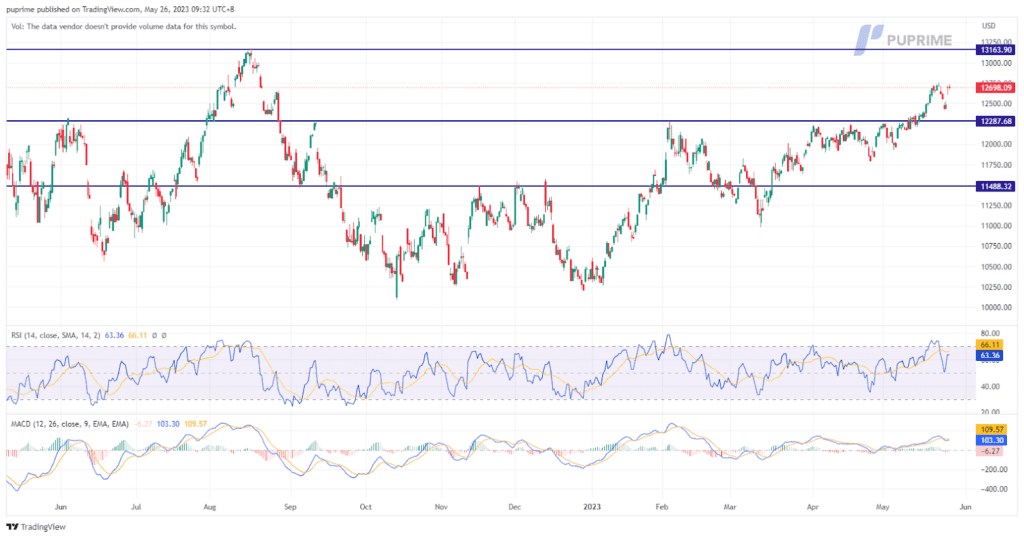

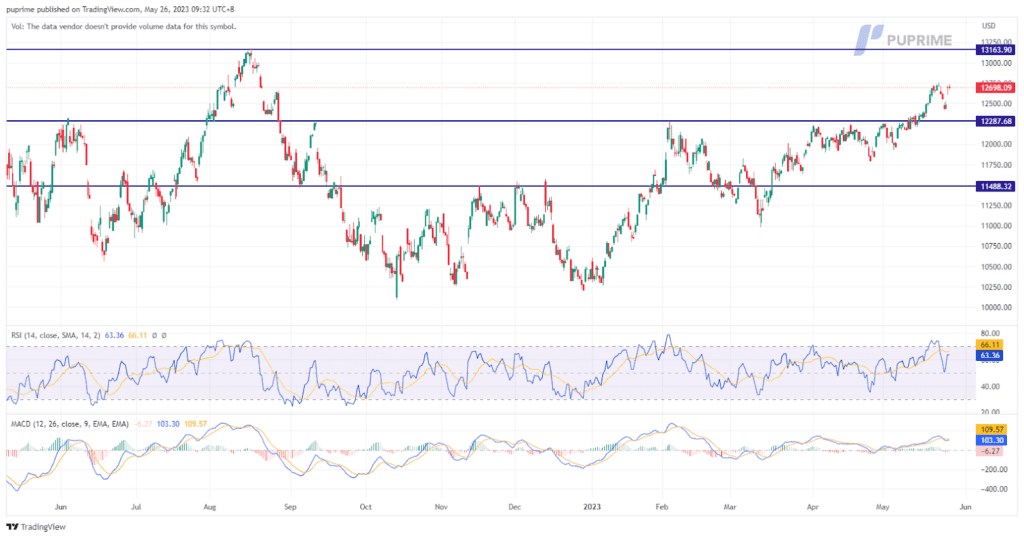

The Nasdaq index experienced a significant surge of 1.71%, reaching 12,698 points, driven by the remarkable performance of Nvidia and the subsequent rush for AI-related stocks. Nvidia Corp (NVDA.O) saw its stock price soar by 24%, hitting a record high, following its impressive revenue forecast that exceeded estimates by 50%. The company’s commitment to meeting the rising demand for AI chips further fueled the rally in AI-related firms. Notably, Microsoft Corp (MSFT.O) and Alphabet Inc (GOOGL.O), key players in the AI sector, saw their stock prices rise by 3.9% and 2.1%, respectively. Other notable gainers included Advanced Micro Devices Inc (AMD.O) with an 11% jump, Micron Technology Inc (MU.O) with a 4.6% increase, and Broadcom Inc (AVGO.O) with a gain of over 7%. These collective successes of AI-related companies played a pivotal role in boosting the overall performance of the Nasdaq index.

With a positive overall outlook compared to other indexes, the Nasdaq remains a valuable asset worth focusing on for investors.

Resistance level: 13163, 14163

Support level: 12287, 11488

The Japanese Yen extended its losses due to the widening yield spread between the United States and Japan. The growing disparity in yields has made the Japanese Yen less attractive compared to the US Dollar. Amidst this backdrop, experts, including Toshihiro Nagahama, an economist who participated in a key government panel, assert that the Bank of Japan (BOJ) should refrain from raising its short-term interest rate target of -0.1 percent until there is clarity regarding steady wage growth in the coming year. Conversely, market participants have increasingly anticipated a potential rate increase by the Federal Reserve during the upcoming FOMC meeting in June, rather than maintaining the status quo.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 141.65, 145.10

Support level: 138.95, 136.25

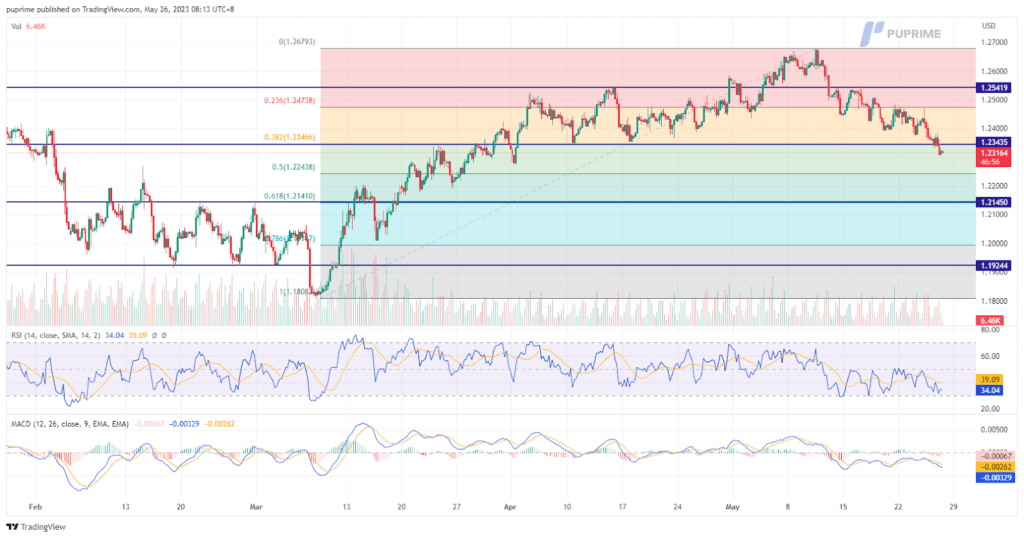

On Wednesday, the British pound dropped by 0.39% to $1.2316 against the strengthened dollar. A decline in the pound was influenced by multiple factors, including the release of better-than-expected U.S. initial jobless claims and GDP data, which bolstered the dollar and increased stress on the pound’s value. The upbeat readings in these economic indicators prompted a strengthening of the dollar, making it more attractive to investors. The ongoing discussions surrounding the debt ceiling issue also provided some optimism in the market, further boosting the dollar and putting downward pressure on the pound. As a result, the pound faced challenges against the robust dollar in the currency market.

The British pound encountered a significant development in its price movement as it broke below a crucial support level. Additionally, technical indicators such as the RSI and MACD signal a weak momentum in the current market conditions. This combination of factors suggests a bearish outlook for the pound.

Resistance level: 1.2540, 1.2680

Support level: 1.2345, 1.2145

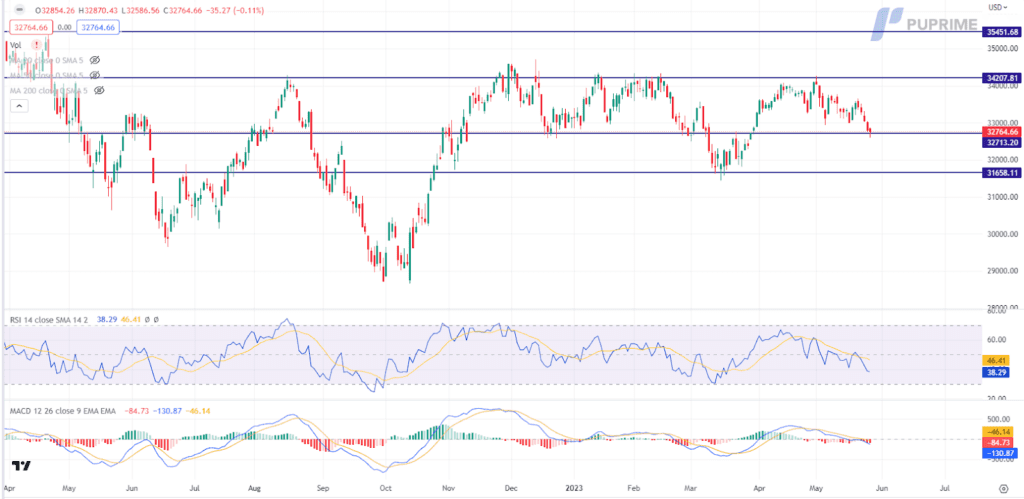

The Dow Jones Industrial Average experienced a modest decline as the energy sector faced a notable downturn. The retracement in the oil market has cast a shadow over the prospects of the oil industry, resulting in APA Corporation, Devon Energy Corporation, and Chevron Corp acting as restraining factors for the broader US equity market. Simultaneously, there has been a growing anticipation of a potential rate hike by the Federal Reserve in June, with market participants significantly raising their expectations. The probability of a rate hike has surged to 53%, compared to the previous estimate of 36%. Higher interest rates typically increase borrowing costs for businesses, which can hamper their profitability and growth prospects.

The Dow is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 34210, 35450

Support level: 32715, 31660

Oil prices slumped 3.36% to $71.79 on Thursday. In a recent interview with Izvestia, Russian Deputy Prime Minister Alexander Novak expressed that the Organization of Petroleum Exporting Countries (OPEC) and its allies are unlikely to implement additional production cuts at their upcoming June meeting. Following Novak’s remarks, oil prices experienced their most significant drop since early May. The market reacted to Russia’s stance, downplaying the possibility of further OPEC+ production cuts. This development has added downward pressure on oil prices, signalling potential challenges for the oil market in the near term.

The unexpected break below the ascending triangle in oil prices suggests a mixed outlook. If the price can sustain within the triangle, there is potential for upward movement. However, further downside is possible if it fails to do so and continues to decline. It is important to closely monitor the price and exercise caution when making investment decisions.

Resistance level: 73.32, 76.88

Support level: 70.99, 65.57

以行業低點差和閃電般的執行速度交易外匯、指數、貴金屬等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!